- #SANGAMON COUNTY PARCEL SEARCH FOR FREE#

- #SANGAMON COUNTY PARCEL SEARCH HOW TO#

- #SANGAMON COUNTY PARCEL SEARCH REGISTRATION#

Books about church histories and church records can be found online county histories, through WorldCat at many libraries and through a subject search of the FamilySearch Catalog.

#SANGAMON COUNTY PARCEL SEARCH HOW TO#

See Illinois state wiki article Church Records for more ideas about how to use church records in your research. Federal Census Mortality Schedules Ancestry ($) Only includes those persons who died within the year previous to the census enumeration.Ĭhurch records can give birth, death and marriage information as well as indictate family relationships. FHL 973 X2pc 18 digital version at Google Books.

Additional comments sometimes include the name of a parent or exact place of death. The ledger books include name, age, cause of death, place of birth, and location of burial plot. The Oak Ridge Cemetery Interment collection includes six volumes, covering the years 1858 - 1940.

#SANGAMON COUNTY PARCEL SEARCH FOR FREE#

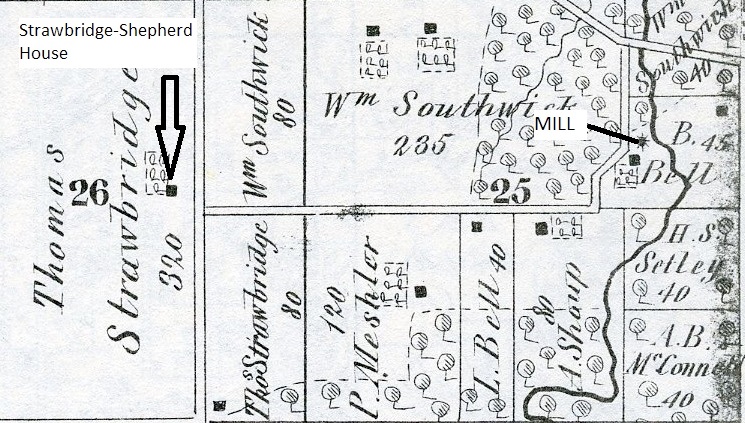

Boundary Changes įor animated maps illustrating Illinois county boundary changes, "Rotating Formation Illinois County Boundary Maps" (1790-1869) may be viewed for free at the website. The County is located in the Southeastern area of the state.

The county seat is Springfield and the county was organized on 1821. The county was named for the Sangamon River, which runs through it.

#SANGAMON COUNTY PARCEL SEARCH REGISTRATION#

*Statewide registration for births and deaths started 1916. Sangamon County Organization Known Beginning Dates for Major County Records 7.15.3 Illinois Regional Archives Depository (IRAD).You may also get this number from your county assessor's office. If your property tax is paid through your mortgage, you can contact your lender for a copy of your bill. If you qualify for the Illinois Property Tax Credit, you will need your Property Index Number, sometimes called "parcel number" or "permanent index number." This number is located on your county tax bill or assessment notice (for property tax paid on your principal residence during the tax year for which you are filing your return).

0 kommentar(er)

0 kommentar(er)